Efficiency, Fairness, and the Externalization of Reasonable Risks: The Problem with the Learned Hand Formula

By

By

Gabriel Weil[1]*

Judge Learned Hand famously advanced an explicit, quantitative, risk-utility test for negligence liability, holding that a defendant breaches her duty of care when she fails to take precautions that are less burdensome than the expected harm that would be prevented by such precaution. That is, breach occurs when B < P*L, where B is the burden of the forgone precaution, P is the probability of injury, and L is the magnitude of the potential injury. This test, the Hand formula, is often held up as a paragon of law and economics, with its focus on rules of law that maximize efficiency. Unfortunately, the Hand formula fails to deliver the promised efficiency for three reasons. First, even perfectly accurate implementation allows the externalization of reasonable risks, leading to an excessive volume of risky activities that generate risks for third parties. Second, as implemented in practice, it insufficiently deters modes of activity (driving an SUV, keeping a pet rottweiler) that generate larger external risks than available alternatives (driving a compact sedan or biking, keeping a pet poodle) even when reasonable care is exercised. Finally, even small, symmetric errors in its application substantially distort level of care choices.

These three failure modes all point toward strict liability as the best mechanism for optimizing injurer incentives for care, volume of activity, and mode choice. However, this conclusion ignores the role of victim conduct in generating injury risk by engaging in voluntary transactions, exercising inadequate care to protect themselves from injury, and engaging in activities that expose themselves to unnecessary risk of injury, even when conducted with reasonable care. These victim conduct considerations point toward retaining a Hand formula-based negligence approach to second-party harm in the context of voluntary transactions and adopting a comparative causal responsibility regime that optimizes the balance between injurer and victim risk abatement incentives for third-party harms.

As every 1L torts student learns, in United States v. Carroll Towing Co., Judge Learned Hand articulated an explicit, quantitative, risk-utility test for evaluating breach of duty in negligence cases.[2] Under this test, a defendant has breached her duty of care if she failed to adopt a risk mitigation measure which would have cost less than the expected harm she could have avoided by adopting the measure.[3] Expected harm is calculated by multiplying the probability of injury by the magnitude of the injury.[4] In symbolic notation, breach occurs when B < P*L, where B is the burden of the forgone risk mitigation measure, P is the probability of injury, and L is the magnitude of the loss that would occur in case of injury. Since taking reasonable precautions will not generally reduce the probability of injury to zero, P is rightly interpreted as the difference in the probability of injury depending on whether the mitigation measure at issue is undertaken.[5]

Richard Posner has championed this Hand formula, arguing that it optimizes safety, producing an efficient balance between minimizing the burden of precautions and minimizing the cost of injuries.[6] The Hand formula remains influential in both legal education and legal practice. Every U.S. law student reads Carroll Towing, usually as the culmination of their study of breach of duty.[7] The Hand formula appears to crystalize the fuzzier notions embodied in other breach of duty cases and their tests. While students may be skeptical that the B, P, and L parameters in the Hand formula can be meaningfully quantified in most cases, they generally accept that the formula embodies an ideal that would be worth pursuing if it could be done with reasonable fidelity, at least to the extent that they accept that the goal of a test for breach of duty is to optimally regulate injury risks. Even in the majority of cases where quantification of the B, P, and L parameters appears infeasible then, many law students, lawyers, and judges accept that some loose approximation of the Hand formula is the ideal that the law is and should be striving for. This Paper challenges that conclusion.

Some critics argue that the Hand formula is flawed because economic efficiency should not be the primary determinant of tort liability decisions.[8] Others question whether judges and juries have the necessary information and capacity to make meaningful risk-utility judgments.[9] This Paper takes a different approach, critiquing the Hand formula from within a law and economics perspective. That is, I argue the Hand formula is an inappropriate test in a large class of tort cases, even if economic efficiency is the primary goal and judges and juries are unbiased and reasonably accurate in applying the test.

The Hand formula fails on its own terms for three reasons. (1) By allowing the externalization of reasonable risks, the Hand formula will tend to induce a suboptimally large volume of activity that creates reasonable external risks.[10] (2) By declining to hold injurers liable when they take cost-effective mitigation measures, the Hand formula will tend to insufficiently deter modes of activity that generate greater risks to third parties.[11] (3) Even symmetric errors in applying the Hand formula can generate substantial distortions in level of care decisions.[12] These three failure modes will be explored in detail in the following parts. This Analysis will focus primarily on cases of third-party harm, where there is no voluntary relationship between the injurer and the victim. While the volume of activity failure mode laid out in Part I and the distortions generated by errors in applying the Hand formula (Part III) have received some attention in the scholarly literature,[13] the failure of Hand formula negligence to reliably modulate the riskiness of mode choice (Part II) has been neglected and represents a novel contribution of this article.

Part IV complicates this picture, by considering the role of victims in injury cases, including (A) choosing to engage in voluntary transactions with their injurers, (B) choosing their own level of care to exercise, and (C) choosing to engage in non-negligent behaviors that increase their exposure to risks from others, thereby participating in the reciprocal generation of risk externalities.[14] Each of these aspects of victim conduct tempers the reforms to tort liability that might appear warranted by an exclusive focus on optimizing for injurer care, volume of risky activity, and mode choice. Part V addresses the common objection that courts don’t really apply the Hand formula, so this critique is irrelevant. Part VI proposes a novel comparative causal responsibility framework for assessing liability in cases of third-party harm where neither the injurer nor the victim breached their duty of care as assessed by the Hand formula. This framework optimizes the balance between providing injurers and victims incentives to abate injury risk. Part VII concludes.

Many activities and practices create substantial risks for third parties even when reasonable precautions are taken. Indeed, the very nature of the Hand formula implies the existence of risks that it is not worthwhile to mitigate.[15] Accidents arising from such risks are commonly referred to as “unavoidable accidents,” though they are seldom unavoidable in a literal sense.[16] Consider two examples: auto collisions with pedestrians and dog bites. In both cases, in addition to deciding what level of care to exercise, potential injurers must also decide whether to take a particular car trip or keep a particular pet. In principle, courts could examine not taking a particular car trip or not keeping a particular pet as potential risk mitigation measures and assess them under the Hand formula. In practice, such analysis does not occur, and courts would struggle to meaningfully assess the burden it would have imposed on the defendant to forgo the risky activity or practice.[17] The value of a car trip to the driver (and any passengers) or a pet to its owners is highly subjective and not conducive to meaningful quantitative analysis by judges and juries. Yet there are surely car trips and (dare I say?) pets that provide only marginal net (accounting for private costs) utility to drivers and pet owners, such that their net social utility, accounting for risks to third parties, is negative. In this sense, the Hand formula approach to tort liability effectively subsidizes activities and practices that generate reasonable risks by allowing those risks to be externalized, meaning offloaded onto third parties without compensation.[18] That is, the Hand formula approach to liability fails to optimize the volume of vehicle miles traveled and the quantity of potentially dangerous pets owned.[19] If drivers and pet owners expected to be responsible for the injuries resulting from their car trips and pet ownership regardless of the level of care they exercise, they would have an incentive to consider the risk externalities they generate in deciding whether to take a marginal car trip or acquire a marginal pet.[20]

Most of my scholarship addresses climate change mitigation. While climate change is too big and diffuse a problem for the tort system to handle effectively, greenhouse gas-emitting activities do share some essential features with activities and practices that generate more direct, physical risks. From an economic point of view, the reason global greenhouse emissions exceed their optimal level is that the private cost of emissions-intensive goods and services does not reflect their social cost.[21] That is, greenhouse gas emissions create negative externalities, costs to third parties that are not included in the price of carbon-intensive goods and services.[22] On reflection, however, there is no one-to-one relationship between a particular marginal ton of carbon dioxide and any particular harms suffered by anyone. Instead, each marginal ton increases the risks of such harms, and a social cost of carbon estimate is extracted based on the expected damage.[23] This expected damage is not unlike the P*L of the Hand formula. The orthodox economic prescription for this sort of externality is a carbon tax.[24] A carbon tax internalizes the external social cost of carbon-intensive goods and services—a social cost that arises from the risks of damage generated by a marginal ton of carbon dioxide.[25] The idea is that producers will adopt emissions-abatement measures that cost less than the social cost of carbon per ton abated to implement and that consumers will shift their consumption patterns such that they no longer consume marginal carbon-intensive goods and services for which the net private benefit does not exceed the expected harm caused by the associated emissions.[26]

The direct analog to a carbon tax in the accident context would be some sort of fee that scales with the riskiness of conduct—universal Pigouvian taxation, perhaps with the revenue dedicated to a victim’s compensation fund. This is an impractical approach to most of the externalities involved in tort suits. However, strict liability is a decent approximation of the role played by a carbon tax—injurers pay for the harms caused by their actions, regardless of whether their actions would have passed an ex-ante risk-benefit test. By contrast, consider applying the Hand formula liability model to climate change. For every action that generates greenhouse gas emissions, a third-party assessment would be required to determine if some mitigation measure (e.g., improvements to the efficiency of an engine, or installation of carbon capture technology) would have passed a risk-benefit test. Meanwhile, either the volume of emissions-intensive activity wouldn’t be controlled at all, or a third-party would have to assess the subjective value of each act of emissions-intensive production and consumption and try to determine whether the net private value associated with it exceeds the net external social cost. Neither of these approaches would be at all satisfactory.

This comparison should give us at least some pause before accepting that the notion that explicit, ex post, risk-benefit analyses conducted by a third party that lacks the capacity to evaluate whether the underlying risk-creating activity is worthwhile are likely to produce a socially optimal balance between risk and benefits in the tort context. To be sure, there are important differences between global climate change and, say, personal injury cases. But those mostly relate to the lack of an identifiable victim for the harm caused by a marginal ton of carbon dioxide and the complicity of almost everyone in the world in generating the risk.[27] The underlying economic logic, that law best promotes efficiency by internalizing negative externalities in cases where transaction costs bar ex-ante Coasean bargaining, is quite similar.[28]

Lord Reid comes close to embracing this view in Bolton v. Stone.[29] In Bolton, a woman who was walking just outside her home was struck in the head by a cricket ball, launched from a nearby cricket field.[30] Lord Reid avows that it is proper to examine “not only how remote is the chance that a person might be struck but also how serious the consequences are likely to be if a person is struck.”[31] This, as Mario Rizzo points out, is just the P*L side of the Hand formula.[32] But Lord Reid goes on to expressly disavow risk-utility balancing, saying “[B]ut I do not think it would be right to take into account the difficulty of remedial measures. If cricket cannot be played on a ground without creating a substantial risk, then it should not be played there at all.”[33] Reid nonetheless rules in favor of the defendant, concluding that the risk was “extremely small.”[34] Within the class of activities that generate “substantial risk,” Lord Reid would push the responsibility for risk-utility balancing onto potential injurers, but he retains a role for courts in assessing the reasonableness of the overall magnitude of risks to third parties. At least in cases like Bolton v. Stone, where there is no question of plaintiff negligence, it is unclear what benefits this compromise position holds relative to strict liability. As we will see in the next Part, however, the role of victim conduct does complicate the case for pushing the risk-benefit calculus fully onto potential injurers by holding them liable for all harms they cause.[35]

Posner, writing with William Landes, holds up a similar later case as an exemplar of judicial application of the Hand formula.

In Nussbaum v. Lacapo[36] the plaintiff was struck by a golf ball which the defendant had hit out of the golf course. The court alluded to the cost of care by noting that “even the best professional golfers cannot avoid an occasional ‘hook’ or ‘slice,’”[37] but its emphasis was on the low probability of this particular accident . . . . Maybe the defendant could have hit the ball more carefully but the cost of care would have been disproportionate to the cost of the accident discounted by the extremely low probability that a careless shot would injure anyone. And as the court pointed out, it is not easy, even for a professional golfer, to avoid an occasional hook or slice that might carry out of the course. (emphasis added)[38]

Landes and Posner’s analysis of this case emphasizes the low probability of injury and the high burden of effective precaution.[39] With a low P and high B, even a relatively large injury would not result in an expected harm, P*L, that exceeds the burden, B, of effective precaution. Even assuming that Landes and Posner are correct that risk-utility balance is sufficiently lopsided so as to rule out of the possibility of error in applying the Hand formula in this case, it nonetheless illustrates the second failure mode of Hand formula negligence. If golfing with a reasonable degree of care generates risks of injuries to third parties, should golfers and course operators not factor that in when deciding how many rounds of golf to play and whether to build a marginal (or marginally larger) course?

This failure mode of Hand formula negligence has been widely recognized in the scholarly literature, including by Landes and Posner.[40] Landes and Posner’s response is to argue that strict liability has an offsetting failure mode: subsidizing excessive volume of risky activities by victims.[41] This issue is addressed in detail in Parts IV and VI, where I argue that it suggests an alternative framework of comparative causal responsibility.

More recently, David Gilo and Ehud Gittel have identified a second volume of activity-related failure mode for Hand formula negligence. Namely, potential injurers may adopt a level of activity below the socially optimal level in order avoid the obligation to undertake costly precautions.

Assume that a factory may choose between different levels of production and may invest in precautions that would eliminate any possible harm. Assume that the costs of precautions do not depend on the level of production. For example, suppose that the above-mentioned factory can avoid any pollution by elevating its smokestack at a cost of $120. Suppose also that the factory can choose between engaging in a low activity level or a high activity level. In the low activity level, the factory’s profits will be $1000, and the harm inflicted on nearby residents will be $110. In the high activity level, where the factory produces more, its profits will increase to $1100, but the harm inflicted on nearby residents will increase to $130.

Under a negligence regime, applying the Hand formula, the factory would be liable if it could prevent the harm by investing in cost-effective precautions. In the low activity level, the loss to residents ($110) is smaller than the cost of elevating the smokestack ($120). In the low activity level, therefore, the factory is neither required to raise its smokestack nor is it required to compensate the residents. Consequently, since it will not bear any costs for precautions or liability, the factory’s benefit while operating at low activity will be $1000. In contrast, in the high activity level, the harm to the residents ($130) outweighs the costs of precautions ($120). Looking to avoid paying $130 in damages, the factory must invest $120 in elevating its smokestack. Thus, when operating at high activity, the factory’s benefit includes its profits from production ($1100) less its costs of elevating the smokestack ($120), for a total of only $980. Looking to maximize its payoff ($1000 > $980), the factory would therefore set its activity at the low level. [42]

Under strict liability, by contrast, potential injurers would have appropriate incentives to modulate their activity levels in addition to their level of care, such that it neither exceeds nor falls short of the social optimal level.[43] Of course, this improvement in injurers’ incentives must again be balanced against potential distortions in victim conduct, which is the subject of Part IV.[44]

Consider again the cases of vehicle collisions with pedestrians and dog bites. In addition to choosing what level of care to exercise in driving a car and keeping a pet, and choosing how many miles to drive and how many dogs to own, potential injurers often make a third type of choice. They must choose what we might call the “mode” of activity or practice. People who want to get from Point A to Point B choose whether to bike, drive a compact sedan, or drive a full-size SUV, among other options. Dog owners choose between keeping a poodle, a golden retriever, and a rottweiler, among other options. This choice of mode modulates the amount of risk third parties are exposed to by potential injurers’ activities in a manner distinct from the degree of care exercised or the volume of activity. Heavier vehicles are much more likely to kill pedestrians with which they collide.[45] Larger, more aggressive dogs are much more likely to cause serious injury if they bite someone.[46] However, courts do not and should not simply say that driving an SUV or owning a rottweiler is categorically unreasonable. For many people, the net private benefits of driving an SUV or owning a rottweiler will exceed the external social costs.

In principle, the Hand formula could incorporate mode into the analysis in two ways. First, as with the volume of risky activity, courts could try to assess whether driving an SUV on a particular trip or owning a rottweiler passes a risk-benefit test. As with the volume of risky activity, this would entail subjective judgments that courts are poorly positioned to make, and they generally decline to attempt them. One might think such judgments would be easier in the business context, where benefits and burdens can at least be cashed out in monetary terms. But Posner expressly rejects any such inquiry:

For the same reason we should not expect the courts to attempt interindustry safety comparisons, although the Hand formula, followed literally, would require them to do so. Suppose the cost of installing air brakes would exceed the cost of the accidents that they would prevent; that does not conclude the analysis. If a system of canals and roads provides nearly as fast and cheap a method of transportation as the railroads, and one that is a good deal safer, the economically optimizing solution may be neither to require the installation of air brakes nor to countenance the accidents resulting from their absence, but, rather, by making the railroads liable, to induce the substitution of canals for railroads.[47]

Posner is endorsing and explaining prevailing practices, not advocating for any change.[48] Even for interindustry comparisons, for which we have more objective market indicators of value, the most prominent defenders of the Hand formula and most courts do not consider it practicable to extend the reach of the formula to governing mode directly.

To be sure, mode choice does sometimes enter into breach of duty assessments, but typically not in cases where explicit risk-benefit balancing plays a decisive role. For instance, statutes may bar or otherwise restrict the use of particular modes in order to reduce injury, or be incorporated into the common law of torts via the doctrine of negligence per se.[49] Likewise, industry custom may discourage the use of modes that generate excessive risks of third-party harms, with departure from customary practice treated as evidence of negligence.[50] But courts rarely, if ever, engage in explicit balancing of the private benefits of riskier modes against the expected costs of the potential third-party injuries they may induce.[51]

However, there is a second, indirect way in which the Hand formula might influence mode choice. The degree of care required could adjust in response to changes in the risk to third parties generated by a particular mode. Drivers of SUVs could be required to undertake more costly precautionary measures than drivers of compact sedans, who, in turn, would be required to undertake more costly precautionary measures than bicyclists, at least in terms of guarding against risks to third parties.[52] Likewise, owners of rottweilers could be required to invest more in precaution than owners of golden retrievers, and still less precaution could be demanded of poodle owners. Followed literally, the Hand formula would surely require such variation in the amount of care required. After all, since the expected harm, P*L, from collisions with SUVs or bites from rottweilers is larger than that from collisions with compact sedans or bites from poodles, a larger B is justified to prevent that expected harm.

In this respect, explicit risk-benefit balancing may have an advantage over more intuitive, customary, or statutory approaches to assessing breach of duty. Custom and intuition probably do tend to support requiring owners of rottweilers to take greater precautions to prevent bites than poodle owners, but it is not clear that the same can be said of the duties imposed on SUV drivers as compared to compact sedan drivers. The precautions that custom, intuition, and statutes require of drivers—refraining from alcohol consumption, not texting, staying under the speed limit, not running through stop signs or red lights, keeping reasonable attention on the road, checking mirrors and blind spots before changing lanes—are largely unrelated to vehicle size for ordinary private cars. Bicycles may be given more leeway on some of these points, and buses and heavy-duty trucks may have to take more precautions still, but the precautions required of an SUV driver are not notably greater than those of a compact sedan driver.

In any case, even rigorous, explicit risk-benefit analysis that required more precautions for more dangerous modes would not reliably induce an optimal allocation of activities and practice across modes. To be sure, knowing that the law will expect them to take more precautions against risks of third party injury if they choose to drive a heavier vehicle would give drivers some marginal incentive to choose lighter vehicles. However, whether this incentive is adequate will depend crucially on the shape of the risk mitigation curve.

The Hand formula modulates mode choice reasonably well in cases where the external risk decays exponentially with investment in precautionary measures. Take a simplified case where a given increment of precaution, say $100 worth, reduces the probability of injury by one percent, without affecting the magnitude of the injury. That is, P=0.99B/$100. So, an additional $100 worth of precaution would reduce a 50% risk to a 49.5% risk. This would be worth it if the magnitude of the potential injury is more than $20,000, because $100=$20,000*0.005. If the magnitude of the anticipated injury were $50,000, by contrast, it would be worth investing in sufficient precaution to reduce the probability of injury to 20%, because $100=$50,000*0.02. This example, where the probability of harm decays exponentially with risk, has the nice feature that the total expected harm that is permitted is $10,000, regardless of mode choice, so long as the total magnitude of the anticipated injury is greater than $10,000. The amount that the potential injurer must invest to avoid liability does vary with mode, however. If the magnitude of the injury is $20,000, the potential injurer would have to spend $6,896 to reduce the risk from 100% to 50%, which would reduce external risk by $10,000. If the magnitude of the injury is $50,000, the potential injurer would have to spend $16,014 to reduce the risk to 20%, which would reduce external risk by $40,000. In this case, the rest of society should be indifferent to whether the potential injurer chooses the mode that generates a larger or smaller inherent risk, since the residual risk that the potential injurer can non-negligently externalize is $10,000 in any case.[53] Of course, in practice, many precautions are likely to decrease both the likelihood and the magnitude of potential injuries, but that does not fundamentally change the structure of the incentives involved, so long as an exponential decay relationship between B and P*L holds.

Unfortunately, not all risks decline exponentially with investment in precaution. If there are few meaningful risk abatement opportunities that cost more than would be justified for a less risky mode than for a riskier mode—that is mitigation measures for which PCS*LCS < B < PSUV*LSUV—then this effect will not matter much, even if risk-utility balancing is rigorously enforced. Real-world risk-abatement functions are often lumpy, and there may be few additional precautionary measures that are risk-benefit justified for a mode that generates twice as much external risk as the less risky mode. In such cases, riskier modes will generate substantially greater external risk without a commensurate increase in the precaution required by potential injurers.

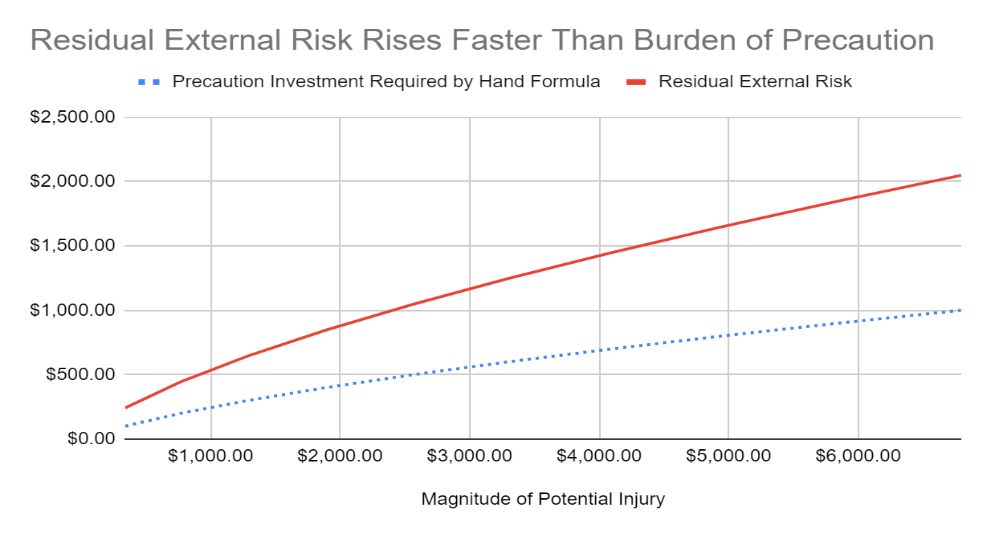

Moreover, the Hand formula can perform poorly in regulating mode choice even given a smooth, continuous risk-abatement function that monotonically rewards incremental investments in precaution. Consider a risk-abatement function that follows a power law, like P=(1+B/$100)-1/2. The first $100 invested in precaution reduces the probability of harm from 100% to 70.71%. This means that the magnitude of the anticipated injury would only have to be $341.42 for $100 worth of precaution to be required by the Hand formula. The next $100 reduces the risk of harm to 57.74%, for an incremental reduction of 12.98%. An anticipated injury of $770.67 or more in magnitude would justify this second increment of $100 worth of precaution. An additional $100 investment in precaution reduces the risk to 50.00%, for an incremental risk reduction of 7.74%. A $1,292.82 anticipated injury would be needed to justify this third $100 increment of precaution. The fourth increment of $100 worth of precaution would reduce the probability of injury to 44.72%, or an additional 3.90% reduction in risk. A potential injury of $1,894.43 or more would be needed to justify this precaution under the Hand formula approach. A total of $500 investment in precaution would reduce the probability of injury to 50.82%, representing an incremental 1.22% reduction in risk over $400 worth of precaution. The potential injury would have to be $2,566.39 before the Hand formula would require $500 worth of precaution. The quantity of residual external risk, meaning the risk of uncompensated third-party harm that remains after all precautions required by the Hand formula have been taken, varies significantly across these scenarios. A potential injury of $341.42 with sufficient precautions ($100 worth) taken to reduce the probability to 70.71% generates $241.42 worth of residual external risk. The table and chart below display additional $100 increments of precaution, up to $1,000.[54]

Table 1

| Precaution Investment | Probability of Injury | Minimum Injury Size | Residual External Risk |

| $100 | 70.71% | $341.42 | $241.42 |

| $200 | 57.74% | $770.67 | $444.95 |

| $300 | 50.00% | $1,292.82 | $646.41 |

| $400 | 44.72% | $1,894.43 | $847.21 |

| $500 | 40.82% | $2,566.39 | $1,047.72 |

| $600 | 37.80% | $3,302.09 | $1,248.07 |

| $700 | 35.36% | $4,096.50 | $1,448.33 |

| $800 | 33.33% | $4,945.58 | $1,648.53 |

| $900 | 31.62% | $5,846.05 | $1,848.68 |

| $1000 | 30.15% | $6,795.13 | $2,048.81 |

Figure 1

As you can see, for each $100 increase in precautionary investment required by the Hand formula, the residual external risk increases by more than $200. This means that, under the Hand formula approach to tort liability, the law only requires potential injurers to bear less than one-third of the third-party injury-related costs generated by choosing a riskier mode. So long as a riskier mode generates private benefits that exceed the cost of the incremental increase in precaution required by the Hand formula, rational, self-interested, potential injurers will choose the riskier mode without regard to the incremental residual external risk generated. More generally, when risk reduction follows a power law rather than an exponential decay function, the risk of third-party injury tolerated by the Hand formula negligence test increases with the magnitude of the potential injury under the Hand formula approach. This means the rest of society should care about whether potential injurers choose more or less dangerous modes.

One might reasonably question whether a power law relationship is a realistic model for investments in risk reduction. The point, however, is that the shape of risk abatement curves is likely to vary substantially across different types of risks, activities, and practices. The exponential decay relationship is a special case where the Hand formula happens to perform well if executed perfectly. Any deviation from exponential behavior in a risk abatement curve is likely to produce some variation in residual external risk across modes. That means that the Hand formula cannot be trusted to reliably provide potential injurers with the proper incentive to choose socially optimal modes of activity.

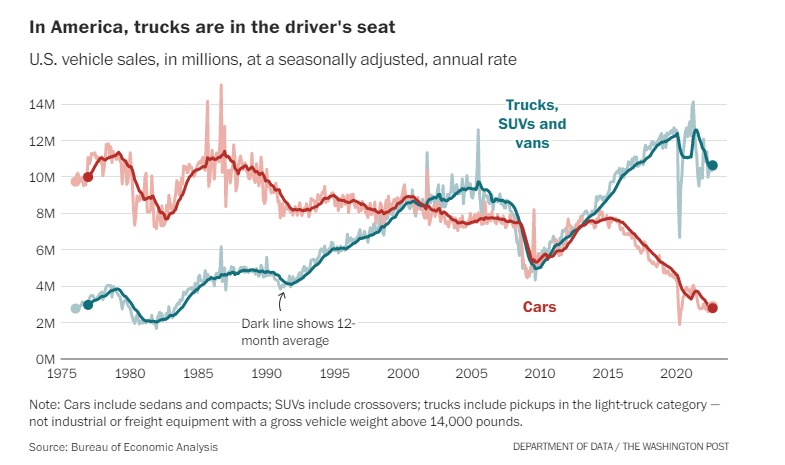

This increasing residual external risk is particularly problematic in the context of auto collisions inasmuch as drivers and passengers in larger and heavier vehicles are less likely to be injured than drivers and passengers in lighter vehicles.[55] In particular, drivers and passengers in the relatively larger and heavier vehicle are less likely to be injured in a two-vehicle collision.[56] If, absent provably insufficient care on the part of one of the drivers, both drivers will be financially responsible for their own injuries, then safety considerations will tend to push drivers toward larger and heavier vehicles, even though an increase in average vehicle size and weight makes roads less safe overall.[57] Indeed, while many factors have likely contributed to this trend, heavier vehicles have steadily grown in market share over the last fifty years. [58]

Figure 2

If drivers are expected to be held financially responsible to pedestrians, cyclists, and drivers and passengers in other vehicles for any injuries that are generated by their transportation decisions, and if insurance premia are adjusted to reflect this financial responsibility, then drivers’ incentives in selecting vehicle size and weight would be much more closely aligned with social welfare.[59]

A somewhat similar dynamic applies to choices about what breed of dog to own. At least some rottweiler owners make their pet selection with the expectation that having a large, aggressive dog in their home will help keep them safe. If they fully internalize those safety benefits but can externalize some of the safety costs to others, too many people will tend to select larger, more aggressive dog breeds. If, instead, the law compelled dog owners to internalize the full social cost of their pet ownership, including the risk of “unavoidable” injuries to others, then the rate of ownership of large, aggressive dogs would move closer to the social optimum.

The core rationale for the Hand formula is that it will induce an optimal level of care by potential injurers.[60] Safety is not the only thing we value, and we need some mechanism for balancing safety against other values. Even if all we valued was life and health, a richer society is better able to deliver longer, healthier lives.[61] So, the law should not be too myopic in how it seeks to induce maximal safety where that is the goal. One way to operationalize this in tort law is to induce the optimal tradeoff between safety and other values, as that leaves us best able to maximize safety.[62] That is, to promote the level of care that provides as much safety as it is worthwhile to provide and no more. Since tort suits typically must place a dollar value on injuries in order to craft a remedy, it is sensible to compare the burden of precaution and the burden of injury in monetary terms. If a 10% chance of an injury that would cause $1,000,000 in damage can be eliminated at a cost of less than $100,000, the law should encourage that prevention to occur. However, if it would cost more than $100,000 to eliminate this same risk, then to do so would represent excessive precaution. Since the goal of tort law is to induce only those precautions that pass a risk-utility test, the logic goes, it does not make sense to impose liability unless the defendant’s actions fail such a test.[63]

Unfortunately, even with regard to precautionary measures, the Hand formula only induces optimal care if implemented perfectly. When average errors are small (but non-zero) relative to cost of optimal precaution, risk-neutral potential injurers will have an incentive to adopt a level of care exceeding the optimal level.[64] This is because incremental investments in care above the socially optimal level will generate reductions in potential liability that exceed the incremental cost of care.[65] That is, incremental reductions in the probability of being held liable that accrue above the optimal level of care distort care decisions, generating private benefits from incremental care that exceed the social benefits of reduced injury risk.[66] When expected errors are small, this effect outweighs the reduced deterrence effect that results from the probability of liability always being below one. When average errors are large relative to the costs of optimal precaution, risk-neutral potential injurers will have an incentive to adopt a level of care below the optimal level.[67] This is because incremental reduction in the probability of being held liable from investments in care falls with increases in average error.[68] At some point, the effect of some probability of evading liability overtakes the incremental reduction in probability of liability, to push the level of care that minimizes the combined private costs of care and expected liability below the socially optimal level.[69]

It’s worth emphasizing that the incentive for overcompliance when expected errors are relatively low is not simple consequence of the possibility of defendants being held liable in case where B > P*L. Rather, it is the possibility of escaping liability through further incremental investments in care above the social optimal level that produces this distortion. To see why, consider cases of potential first-party harm, where individuals and firms take on risks for themselves. If things turn out badly, those individuals and firms must bear the costs of injuries they suffer, regardless of the prudence they exercised in taking on those risks. But we do not generally expect this to induce excessive caution regarding potential first-party harm. Even if individuals and firms must bear the cost of a potential $1,000 loss, it doesn’t make sense for them to spend much more than $100 to reduce the risk by 10%.

As then-professor Posner put it, “When the cost of accidents is less than the cost of prevention, a rational profit-maximizing enterprise will pay tort judgments to the accident victims rather than incur the larger cost of avoiding liability.”[70] To be sure, some individuals and firms are risk-averse, and others may miscalculate the probability or potential magnitude of any injury, but we generally expect individuals and firms, on average, to approximate the efficient level of precaution with regard to first-party harm. For this reason, it is generally accepted that strict liability reliably provides potential injurers with adequate, but not excessive, incentives for caution.[71] So, if potential injurers expect courts to sometimes hold them liable when B > P*L, this will only induce excess caution if they expect further increments of caution to reduce the likelihood of being held liable. If potential injurers expect courts to sometimes fail to hold them liable when B < P*L, by contrast, they will tend to exercise less than optimal caution, since they will be uncertain as to whether they will be held liable in marginal cases.

Consider a scenario where a precautionary measure that costs $900 would reduce the risk of a $100,000 injury by 1%. The expected value of the gross social loss if the $900 precaution is not taken is $1,000 dollars, so the precaution would produce $100 in net expected social benefits. If economic efficiency is the primary function of tort liability, it should provide incentives for potential injurers to take this sort of precaution. However, a rational, self-interested potential injurer will only take that precaution if he expects that, in the event of injury, he is more than 90% likely to be held liable. Even if all injured parties file suit, this still requires an unrealistic level of accuracy in applying the Hand formula to provide sufficient incentive for potential injurers to exercise the appropriate level of care.

Defenders of the Hand formula approach to negligence readily acknowledge the fallibility of judges and juries in assessing breach under the Hand formula. As part of an argument against punishing negligent behavior (over and above liability for injuries it causes), Posner avers that “A standard of care is necessarily a crude approximation to optimality.”[72] Elsewhere, he concedes that:

. . . we rarely have enough information to know what the optimum solution to a problem of conflicting resource uses is. This is true, and it follows that the negligence system produces, at best, crude approximations of the result one could expect if market rather than legal processes were operative.[73]

If courts usually only have enough information to come up with estimates of B, P, and L that crudely approximate reality, it is likely they will fail to hold defendants liable in more than 10% of cases in which the burden is 10% less than the expected preventable harm.[74]

It is also worth noting that, as Guido Calabresi has pointed out, Hand formula negligence would not be the optimal approach to ensuring adequate care, even if judges and juries were capable of implementing it with perfect accuracy.

If we assume that the regulators make no errors in measuring costs, this turnabout does not help achieve our objective of minimizing the sum of accident and prevention costs; indeed, it hinders it. It adds the possibility that injurers will, through error, fail to avoid those accident costs which are cheaper to prevent than to compensate for. If the regulators are right that the accident costs were worth avoiding, it makes no sense to give the injurers an independent opportunity to review the issue. If, instead, we assume the possibility of regulator error, the turnabout may or may not help. To the extent that the error is in overestimating prevention costs, fault will not be found because avoidance will be deemed too costly. Consequently, the loss will lie on the victim, and we will be no nearer our objective than before. To the extent the error lies in underestimating prevention costs, the turnabout does permit injurers to choose the cheaper alternative of compensating rather than preventing the costs.[75]

That is, the Hand formula approach to negligence fails to optimize care if either potential injurers or courts fail to make perfect risk-utility judgments. Combining the Hand formula approach to fault with a liability regime that generally only allows recovery for actual harm produces a system where errors tend to compound, rather than cancel out. Courts only assess liability if they determine that more care should have been taken. When they wrongly assess the level of care taken to have been adequate, injurers face no liability. Potential injurers, in turn, only have an economic incentive to take marginal increments of care when they cost less than the expected liability from failing to adopt them. In their analysis, they face uncertainty about both costs and risk-mitigation benefits of potential precautions and the likelihood of liability should an injury occur. If potential injurers are poor risk-utility calculators, there is no reason to believe the courts declining to assign liability when they judge the precautions taken to have been adequate will help.

The foregoing analysis has focused exclusively on the conduct of potential injurers. This leaves out any consideration on the effects on liability rules incentives for potential injury victims. There are three principal ways in which victim conduct is relevant, two specific and one general: (A) Many injuries occur in the context of a voluntary transaction between the victim and the injurer, such that the risk the victim was exposed to was not a genuine externality. (B) Some victims fail to exercise reasonable precautions to avoid injury. (C) All externalities are reciprocal in the Coasean sense. No injurer’s conduct could produce an injury without the presence of the victim to be injured. Non-negligent victim conduct may modulate the risk of injury significantly in some cases. The following subparts will address each of these issues in turn.

Many injuries occur in the context of a voluntary transaction between the injurer and the victim. Examples include medical malpractice; product liability; workplace injuries; injuries to passengers on buses, trains, airplanes, taxis, and private cars, sustained due to driver error or equipment malfunction; and injuries sustained by hotel guests due to building defects, etc. In these contexts, potential victims can avoid any risk of injury by declining to engage in the underlying transaction. The risks from which any injuries might arise in this context are not true externalities.[76] Indeed, they are internalized by the parties to the transaction. For this reason, they fall outside the core of the critique laid out in the previous three Parts, which is focused on the management of risk externalities.

If markets are functioning perfectly, including perfect information, then any injury risks should be reflected in prices or other contract terms. For workers, this might come in the form of a wage premium that workers are paid to accept a higher risk of injury or death, known as a compensating differential.[77] Likewise, a stay at a hotel that has a reputation suggesting an elevated risk of exposure to bedbugs is likely to be cheaper, ceteris paribus, than a stay at one with an unblemished reputation for cleanliness. These price differentials provide employers, hoteliers, and other market transactors that have some control over the risks that their employees and customers are exposed to with an incentive to mitigate those risks. Again, assuming perfectly functioning markets, including perfect information, this should lead rational market transactors to select the optimal balance between accepting injury risk and incurring the costs of risk abatement. Moreover, the quantity and mode of risky jobs accepted, products sold, and services provided should adjust to reflect the risks associated with them. In other words, in the context of a voluntary transaction in a well-functioning market, there isn’t much work for the tort system to do in governing risks.

This conclusion holds under a no liability regime, a Hand formula-based negligence regime, and a strict liability regime. If markets function perfectly, prices should adjust to changes in the liability regime, leaving the volume and mode of risky activities and practices unchanged. Even with a perfectly functioning market, however, there are some differences in how different liability regimes would play out in the context of a voluntary transaction. Assuming liability is non-waivable, strict liability effectively requires employees and purchasers to take out insurance against any injury they may suffer on the job or as a result of consuming the product or service.[78] That is, the market equilibrium with strict liability will tend toward lower wages for employees and higher prices for customers, which represent an implicit insurance premium paid in exchange for the right to recover damages if injured on the job or by a product or service.[79] The strict liability market equilibrium also prevents differences in risk tolerance across employees and customers from being fully expressed. Relatively risk-seeking employees and customers will not have the option of obtaining a higher wage or lower price by accepting greater physical risk.[80] No rational employer, manufacturer, or service provider would tolerate physical risks that do not maximize expected profits including expected liability for injuries to their employees and customers.

A similar analysis applies to negligence liability based on the Hand formula. Employees and customers with an unusually high risk tolerance will generally find themselves unable to find opportunities to take jobs or purchase goods and services that are too risky to pass muster under the Hand test. If judges and juries apply the Hand formula with high accuracy, maybe we think this is OK. If they make substantial errors, we may question whether it would be better to let the parties involved make their own choices based on their assessment of the risk and risk tolerance rather than having their employer’s or seller’s expectations of what is likely to pass a risk-utility determine the level of care.

If customers and employees misperceive the risks associated with jobs, products, and services, the choice of liability rule is more significant. Under strict liability, prices and wages will reflect accident costs.[81] Except for failing to accommodate individual differences in risk preferences, this means that it will tend to produce an efficient degree of care, volume of risky activity, and mode choice.[82] Employee and customer risk misperceptions will matter more under Hand formula-based negligence liability. If employees and customers totally ignore injury risk (i.e., they assume zero risk), we are back to the dynamics of third-party harm, where the Hand formula with symmetric errors will provide insufficient incentive to take adequate precautions, and even perfect implementation of the Hand formula will lead to an excessive volume of risky jobs, products, and services as well as suboptimally risky mode choices. No liability will also produce inadequate care and excessive volume of risky activity under these circumstances.

If employees and customers perceive risk, but do so imperfectly, the impact of a negligence rule depends on the nature of their misperception. If their perception roughly tracks the underlying risks associated with a particular firm’s jobs, product, or services, just with some noise added, a negligence rule or even no liability will perform adequately.[83] If risk perceptions are unable to discriminate between different providers of similar products and services or different employers of similar workers, however, then imperfectly implemented Hand formula negligence will tend to provide distorted incentives for care, for the same reasons described in Part III.[84] If customers/workers treat all products/services/employers as having the average risk for their class, overall consumption and employment levels will respond correctly, but sellers/employers will have inadequate incentive to invest in risk mitigation, since the benefits would be shared by the whole class of sellers/employers to which they belong.[85] Whether mode of activity is adequately regulated depends on whether customer/employee risk knowledge is sufficiently granular to enable discrimination across modes. Importantly, no liability will produce similar results to Hand formula negligence regarding both volume of risky activity and mode choice, where it is customer/employee knowledge rather than liability that effectively regulates. However, firms would have much less incentive to exercise adequate care under no liability than under Hand formula negligence if customers/employees lack firm-specific risk information.[86] The only incentive would be to lower the perceived and actual riskiness of the class of firms they belong to. In a market with many firms, this is a weak incentive and firms will tend to mostly free ride.[87]

In sum, the primary function of tort liability in the context of voluntary transactions is to overcome information deficits or asymmetries.[88] With perfect information and rational market transactors, no liability produces optimal care, volume of risky activity, and mode choices. Introducing tort liability, whether in the form of strict liability or Hand formula negligence, only adds transaction costs and potentially bars some positive-sum transactions among parties with unusual risk preferences. When customers and employees have no awareness of risk, only strict liability produces optimal care, volume of risky activity, and mode choice. When customers and employees only have class-level risk information, both Hand formula negligence and no liability effectively regulate the volume of risky activity, and effectively regulate mode choice so long as customers and employees have access to mode-level risk information. While imperfectly implemented Hand formula negligence fails to provide adequate incentive for sellers and employers to exercise adequate care, no liability performs much worse on this score, providing extremely limited incentives to exercise care.

This analysis is complicated somewhat by the fact that customer/employee information is endogenous. That is, potential customers and employees will have maximal incentive to gather risk information under no liability, intermediate incentive to do so under Hand formula negligence, and little to no incentive to do so under strict liability. This dynamic, along with considerations of victim care discussed in the next subpart, should give us pause about the desirability of strict liability in the context of voluntary transactions. At the very least, the foregoing considerations do give us strong reasons to think that the case for strict liability is much weaker in the context of voluntary transactions than it is in cases of third-party harm. On this view, it is somewhat anomalous that many of the pockets of strict liability and quasi-strict liability in American tort law, including products liability, workers’ compensation, and common carrier liability, arise in the context of voluntary transactions.

In many cases, potential injury victims have opportunities to exercise care that are comparable to those available to potential injurers. In such cases, as Posner points out, a strict liability rule with no contributory negligence defense would substantially dampen potential victims’ incentives to exercise reasonable care.[89] As Posner readily acknowledges, however, adding a contributory negligence defense to strict liability is sufficient to give potential victims the same incentives to exercise reasonable care that they have under a negligence rule.[90] Under both negligence and strict liability regimes, the contributory negligence rule introduces a potential failure mode in cases where the most efficient solution requires only care on the part of the potential injurer, but there are care opportunities available to the potential victim that are less costly than the expected injury, but more costly than the potential injurer’s care. In symbolic notation, BInjurer < BVictim < P*L. Straightforward application of the Hand formula negligence test to victim conduct in such a case would lead to a finding of contributory negligence if the victim failed to undertake the relevant precautionary measures, even though those precautionary measures are not part of the optimal response to this risk. As Posner argues, this potential inefficiency arises under both a negligence rule and a strict liability rule with a contributory negligence defense, and in both cases, it could be remedied by redefining the contributory negligence defense to exclude such cases.[91] Otherwise, according to Posner, both a negligence regime and strict liability with a contributory negligence defense tend to induce efficient outcomes, at least with regard to victim care.[92]

One might reasonably ask whether the distortions resulting from symmetric errors in applying the Hand formula apply to contributory negligence. The answer is yes, at least in some cases. Consider a potential injurer whose conduct generates $10,000 of expected harm to the potential victim, if the victim invests $0 in precaution. Assume that, absent a finding of contributory negligence, the injurer would be held liable, either under strict liability or for failing to exercise reasonable care. If the potential victim could eliminate the risk entirely by investing $9,000 in precaution, this would generate a social surplus of $1,000. If a jury accurately judges that a plaintiff failed to avail himself of such a precautionary measure, this would support a finding of contributory negligence. In a strict contributory negligence jurisdiction, this would entirely bar the plaintiff’s recovery. Thus, if the jury implemented Hand formula contributory negligence perfectly, the potential injured party would expect to gain $1,000 by undertaking the precaution. If a jury would fail to make a finding of contributory negligence in more than 10% of such cases, however, then a rational risk-neutral potential victim will not undertake such precaution. As with injurer care, however, incremental investments in care on the part of victims, both above and below the B=P*L threshold, will reduce the probability that their recovery will be blocked (or reduced, under comparative negligence) by a finding of victim negligence.[93] This has analogous incentive effects as for injurers, encouraging risk-neutral potential victims to engage excess precaution when errors are small (but non-zero) relative to the costs of precaution, and to fall short of exercising reasonable care when errors are relatively large.[94] As with injurer incentives, the excess caution distortion is driven not so much by courts sometimes finding plaintiffs negligent when they are not, but by the expectation that incremental investments in care above B=P*L would allow the plaintiff to recover.

It’s less clear what to do about this problem. Both injurer and victim incentives are optimized if they expect to bear the full cost and benefit of their choices regarding the level of care to exercise. Strict liability can do this for injurers. No liability can do this for victims. But no system can make both parties bear 100% of the risk of injury. As we will see below, this problem is even more vexing in considering victim choices regarding volume and mode of risky activity.

The comparative causal responsibility framework discussed in Part VI is my attempt to address this challenge. In this framework, victim negligence (in the absence of injurer negligence) would represent a special case in which it is optimal to assign 100% of the responsibility for the injury to the victim. If a jury errs by failing to correctly identify victim negligence, such an error should generally only result in the injurer being held liable for a small fraction of the total injury, which would mostly maintain the incentive for adequate victim care.

As Ronald Coase famously pointed out, all externalities are reciprocal in the sense that they require the presence of both injurer and a victim.[95] Pedestrians could not be hit by cars if they were not walking in spaces near where cars are driven. People could not be bitten by dogs if they confined their activities to private places that rigorously exclude dogs. Or, to use Posner’s favorite example, crops could not be damaged by sparks from a passing train if they weren’t placed near the railroad’s right of way.[96] Even a farmer exercising reasonable care will contribute to some increase in potentially liability-generating risk to his crops by choosing to operate a farm on a tract of land that abuts a railroad’s right-of-way. Just as the railway operator could choose other, lower-risk transport options, the farmer could choose to locate his farm further from the railroad’s operations. Perhaps there are also uses for the adjacent land that would be more compatible to the railroad’s operations. This, Posner suggests, is the mirror image of the concerns raised in Parts I and II above.[97]

This is true as far as it goes. Potential injury victims do make choices about both the volume and the mode of activities they engage in that modulate the quantity of potentially liability-generating risk they are exposed to. In this sense, pedestrians crossing the street, even in a crosswalk with the appropriate walk signal, generate a negative externality for SUV drivers. They could choose to move around less or choose a mode in which they are less vulnerable to automobile collisions. It may seem absurd to blame the non-negligent walker for being struck by a moving car. But the foregoing arguments suggest that there is some basis for holding drivers liable when they non-negligently strike pedestrians because their choices were responsible for generating the collision risk. Once we acknowledge the reciprocal nature of risk externalities, must we conclude that the SUV driver and the walker, both exercising reasonable care, are equally responsible for the injury?

There are two key problems with this line of reasoning as a defense of Hand formula negligence. First, even if the non-negligent SUV driver and the non-negligent walker are equally causally responsible for a given collision, the walker is the party that suffers the lion’s share of the physical injury. Since neither party was negligent, a negligence rule will let the injury lie where it falls. But this implies a judgment that it is more just or efficient for the injured party to bear the full cost of the injury. If the case were totally symmetric, with both parties having equivalent opportunities to reduce injury risk by choosing to travel less or via a different mode, the fairest outcome would seem to be dividing the responsibility equally. The most efficient outcome in such a case, ignoring litigation and other transaction costs for the moment, would depend on the shape of the risk abatement cost curve. If there are decreasing marginal returns to investments in safety, broadly construed to include mode and volume of activity choices, then an equal distribution of responsibility is optimal. Only if there are increasing marginal returns to investments in safety does it make sense to put the full liability (or uncompensated harm) on one party to maximize their incentives for precaution. Since increasing returns are likely to be rare, sharing responsibility equally, by making the injurer bear half the cost of injury, will generally be both more just and more efficient, at least before considering transaction costs.[98]

Second, it is not generally the case that non-negligent injurers and non-negligent injured parties are equally causally responsible for the occurrence of an injury.[99] Consider a collision between non-negligently driven SUV with no passengers and minimal cargo and a non-negligent pedestrian, causing severe injuries to the pedestrian. By stipulation, both the SUV driver and the pedestrian were exercising reasonable care. But both could have avoided the collision by declining to take a car/walking trip on this occasion. The SUV driver also could have significantly reduced the likely harm to pedestrians in the event of a collision by choosing to drive a lighter vehicle. Both parties could have also chosen to exercise extraordinary care. The driver could have driven ten miles below the speed limit, and the pedestrian could have worn a helmet and pads. Further details may offer an indication of each partys’ risk abatement cost curve. If the injury occurred on the shoulder of a highway, we may think the pedestrian could have taken lower-cost steps to avoid the collision. If the collision occurred in the crosswalk on an urban street with heavy foot traffic, we may be more inclined to emphasize the driver’s incentives regarding mode choice and volume of activity. While such determinations of comparative responsibility in the absence of negligence by either party are likely to frequently involve significant elements of subjectivity and imprecision, this is true of many legal determinations, including binary assessments of breach under the Hand formula and the application of comparative negligence rules. There is no clear basis in justice or efficiency for simply assigning all responsibility to the injured party without any attempt to determine whether the injurer might have been better positioned to reduce the likelihood or severity of the injury.

The Hand formula negligence approach does have the advantage of avoiding some litigation in cases where it is clear that no negligence was involved. However, it may increase the need for and cost of litigation to evaluate breach of duty in cases where the presence of Hand formula negligence is unclear. In any case, any increase in litigation and other transaction costs that may arise from a move away from Hand formula negligence would have to be balanced against the efficiency benefits of aligning risk incentives more optimally. The best way to minimize litigation and other related transaction costs would be to adopt a no liability regime, but we tolerate the costs of litigation in order to get the incentive, victim compensation, and other benefits of the existing tort system. It is an empirical question whether the flawed theoretical efficiency case for application of Hand formula negligence in cases of third-party harm can be rescued by appeal to transaction costs.

The most common critical response to early drafts of this Article was that courts don’t really apply the Hand formula in practice, so my critique is of limited relevance. The details of this response varied, from those who noted that judges and juries rarely, if ever, have the information needed to engage in meaningful, quantitative risk-benefit balancing, to more nuanced suggestions that judges and juries only very roughly approximate application of the Hand formula. These responses also emphasized that judges and juries informally incorporate values that bear on reasonableness but do not lend themselves to quantification and lie beyond the scope of economic efficiency.[100] There is some truth to both the strong and weak versions of this response, but neither substantially undermines the core critique laid out above.

It is true that estimating the burden of precaution (B), the (avoidable) probability of injury (P), and the magnitude of the potential loss (L) is rarely straightforward and is often infeasible, even in crude terms.[101] Even in cases that are relatively friendly to quantification, considerations that bear on reasonableness often involve values that are not straightforward to monetize, and juries are not equipped with the tools they would need to engage in rigorous cost-benefit analysis of the sort conducted by regulatory agencies.[102] However, the notion that these values are outside the scope of economic efficiency is mistaken. In principle, economic efficiency in the sense of potential welfare maximization incorporates all human preferences in proportion to individuals’ willingness to pay to have the preference satisfied.[103] While courts may lack effective tools for estimating parties’ willingness to pay to satisfy some preferences, that does not imply that those preferences fall outside the scope of economic efficiency properly understood.[104] At least in principle, economic efficiency should incorporate anything that humans value enough that they would be willing to give up something else for it.

More importantly, while actual implementation of the Hand formula in negligence cases is often impractical, the formula nonetheless represents a crystallization of the ideal that other, less explicit and quantitative approaches to assessing breach of duty are striving toward. That is, the fundamental conception of the duty of care as exercising the level of precaution that a reasonable person would implies some sort of balancing of risks and benefits. After all, the ordinary reasonable person would not be more cautious regarding risk to others than she is regarding risks to herself, at least not substantially so, and such a reasonable person would also not spend more to protect themselves against a risk than the damage harm they expect to suffer absent such precautions. While courts may sometimes lack the epistemic foundation to evaluate this balance in explicit quantitative terms, the various qualitative tests for breach can thus be thought of as crude approximations of the Hand formula. Certainly, prominent advocates of the Hand formula approach to negligence see matters this way.[105]

Accordingly, one might suppose that tort law would reach something close to the normative ideal of economic efficiency if it were somehow possible to implement the Hand formula in a reasonably accurate and unbiased fashion.[106] Unfortunately, as argued in Part III, even relatively small random errors with no systematic bias in implementing the Hand formula produce substantial distortions in incentives for care. If anything, more qualitative formulations of the duty of care will tend to magnify those distortions. The Hand formula’s explicitness just makes the distortions easier to see. The difficulty of estimating the B, P, and L parameters in practice should also give us more concern about the asymmetric effects of random errors.[107]

Similarly, it is well understood that negligence liability generally, not just in its Hand formula instantiation, fails to effectively modulate the level of risky activity.[108] Finally, qualitative approaches to assessing the breach of duty mostly also fail to effectively modulate the riskiness of mode choices. Yes, some modes of activity are restricted by statutes that are incorporated into the common law via the doctrine of negligence per se, and others may be informally restricted by custom.[109] And juries may sometimes have intuitions that certain modes are unreasonably risky. Nonetheless, the binary nature of the breach of duty analysis and the frequent subjectivity of the benefits of riskier modes, like driving an SUV or owning a rottweiler, still leave us with a paradigm in which negligence liability provides potential injurers with insufficient incentives to account for external injury risks when selecting modes of activity. Juries engaged in qualitative reasonableness evaluations are no better equipped to weigh the benefits to driver of an SUV trip against the risk of third-party injury. Adopting a per se rule that driving SUVs on certain roads is unreasonable would be both over—and under—inclusive, failing to discourage many trips with negative social value and labeling defendants unreasonable (though not necessarily deterring the actual trip) in cases where the trip does produce a net increase in social welfare, even compared to driving a lighter vehicle.

A rule or jury posture that is strongly biased (relative to the Hand formula) toward a negligence finding would mitigate the problems laid out in Parts I, II, and III, but at the expense of less effectively regulating victim conduct. That is, it would represent a move toward strict liability and would take on many of the costs and benefits of such a move. If potential injurers expect to be held liable in the vast majority of cases where they fail to adopt precautionary measures that are less costly than the expected value of the avoidable injury, then such an approach would substantially address the concern of inadequate incentives for care laid out in Part III. However, by holding out the possibility of escaping liability for the injuries that do occur with extremely high levels of care, it might still provide incentives for excess care.[110] By holding injurers liable in many cases where they did actually exercise reasonable care, it would also give them somewhat greater incentive to consider injury risk to third parties in choosing the volume and mode of their risky activities. Stopping short of strict liability would render these incentives inadequate to optimize injurer behavior, however. By the same token, potential victims who expect to be compensated for a larger fraction of the injuries they suffer would have reduced incentives to account for injury risk in their own mode and level of activity choices. If an analogous margin of safety is not applied to contributory negligence assessments, they will also have inadequate incentive to exercise reasonable care. In any case, judges and juries do not consistently employ a margin of safety approach to breach of duty assessments for either plaintiffs or defendants. Instead, they are probably better modeled as very noisily approximating the Hand formula approach, with lots of random error but little systematic bias toward or against negligence findings. The failure modes laid out in Parts I, II, and III are much easier to see in the operation of the Hand formula, but a similar, though less precise, critique applies to much of prevailing negligence practice, at least in cases of third-party harm.

Parts I, II, and III laid out a critique of the Hand formula approach to negligence liability, showing that it fails to effectively regulate risk externalities. Under realistic implementation conditions, Hand formula negligence fails to adequately promote efficient levels of care, encourages an excessive volume of risk-externality generating activity, and insufficiently steers potential injurers toward safer mode choices. If we are focused exclusively on regulating injurer behavior, strict liability would represent a complete solution to these problems. Subpart IV(A) points out that cases of second-party harm in the context of voluntary transactions do not represent the realization of genuine risk externalities and so are not properly subject to this critique. Perhaps information problems and/or behavioral market failures can justify the role that tort liability plays in this context, but such issues are beyond the scope of this Paper’s core critique. If participating in voluntary transactions were the only way that victims modulate their own risk of injury, strict liability would still be the ideal approach to third-party harm cases. However, subparts IV(B) and IV(C) showed how victim conduct also modulates injury risk in cases of third-party harm. The victim care considerations discussed in subpart IV(B) clearly warrant at least retaining a contributory negligence rule under strict liability, so injurers are not held liable in cases where only the victim was negligent. In cases where both parties fail to exercise reasonable care, however that is assessed, the standard case for comparative negligence applies.[111] This leaves the question of what to do when neither party is negligent. As suggested above, I propose that liability be distributed pursuant to a comparative causal responsibility analysis.

Table 2

| Negligent Injurer | Injurer Exercised Reasonable Care | |

| Negligent Victim | Comparative Negligence | Full Victim Responsibility (No Injurer Liability) |

| Victim Exercised Reasonable Care | Full Injurer Liability | Comparative Causal Responsibility |

The goal of comparative causal responsibility analysis should be to maximize the joint incentives of potential injurers and victims to account for any injury risk and liability risk externalities that their choices impose on others. For potential injurers, that means considering potential injury in deciding how much risky activity to engage in (e.g., how many miles to drive), what mode to choose (e.g., SUV vs. compact sedan vs. bike), and what level of care to exercise. On each of these dimensions, the expectation that injurers will have to pay the full cost of any injuries resulting from risk externalities that they generate will give them the correct incentive to balance those risks against the benefits of high volumes and risky modes of activity and the costs of precaution.[112] If a given car trip is highly valuable, the expected liability from driving it, even in an SUV, will not deter the driver from taking it. Likewise, drivers will generally not be motivated to take care in excess of that required by perfect application of the Hand formula negligence standard, since that would not yield positive expected benefits.

For potential victims, we want the tort liability regime to seek to give similar incentives, except the externalities involved are potential liability risks rather than physical injury risks. Nonetheless, we want potential victims to account for the injury risk externalities they expose themselves to (and thus potential liability risk externalities they generate), when they choose what volume of risky activities to engage in, what mode to choose, and how much precaution to exercise. Only allocating full responsibility for the injury to both parties would provide them with optimal incentive to mitigate risk.[113]

Under the status quo, the cost of injuries that are not caused by either victim or injurer breach are left to lie where they fall, on the victim. This optimizes victim incentives to invest in risk abatement but offers injurers minimal incentives (based on the potential for errors in breach assessments) to invest in risk abatement. If we instead allocate the responsibility equally between injurers and victims in simple cases with only one injurer and one victim, both parties will be willing to bear a cost (in terms of precaution and/or forgone benefits from high volume of riskier mode of activity) up to half the expected harm from any injury in order to eliminate the risk. More generally, they will be willing to pay ΔP*L/2 for any reduction in the probability of injury, assuming fixed injury magnitude. If both injury probability and magnitude vary with volume, mode, and/or precaution, then parties will be willing to bear a cost up to (P0*L0-P1*L1)/2, where P0 and L0 are the probability and magnitude of potential injury without the party taking account for risk externalities, and P1 and L1 are the probability and magnitude of injury after a set of potential risk mitigation measures are adopted. This is only optimal if a marginal increment of risk mitigation investment, on any combination of the three dimensions, yields equal reduction in expected harm from the potential injurer and the potential victim. Given that investments in risk abatement generally have diminishing marginal returns, however, it will generally be a clear improvement to give both parties half the optimal incentive to invest in risk abatement rather than to give a single party, the victim, the full optimal incentive.[114]